Biden Administration Student Loan Scandal Finally Comes to Light

By The Blog Source

The Biden administration purposefully withheld the actual number of student loan defaults until after the 2024 election, according to recently revealed data. Independent verification now reveals that millions of borrowers were far behind on their payments, despite the Department of Education's near-perfect payback rate claim.

During a crucial election year, Biden's Department of Education concealed default data from credit bureaus. The reported 0.5% of all student loan debt that is currently substantially delinquent has sharply increased to about 8%. Courts overturned nearly $190 billion in taxpayer-funded loan forgiveness initiatives, which were justified in part by the concealment.

It has now been established that the Department of Education concealed crucial data on student loan defaults from credit reporting firms throughout 2024, demonstrating the Biden administration's intent to control the public narrative. Under the pretext of administrative flexibility, this action effectively concealed the financial reality from taxpayers during a crucial election year by keeping the records of millions of severely overdue borrowers artificially clean.

This concealment aided the administration's contentious and unlawful quest for widespread student loan forgiveness—a scheme that has been repeatedly overturned by the courts. The government rationalized billions in debt cancellation programs that amounted to outright vote-buying among young, college-educated Americans by creating the false impression that nearly all borrowers were faithfully repaying their loans.

As of early 2025, around 8% of federal student loan debt was past due by more than 90 days, according to independent analysis from Equifax and the Federal Reserve Bank of New York. Compared to the figures previously released during the Biden administration, that is a more than 1,000% increase. Claims that repayment was stable are clearly undermined by these numbers, which show the worst delinquent rate in five years.

This fabricated illusion had two political functions. First of all, it concealed Biden's economic leadership shortcomings during a period of rising public anxiety about debt and inflation. Second, it enabled the administration to circumvent court decisions by feigning that the repayment system was being restarted in good faith while imposing payment requirements and eliminating all penalties for default.

Furthermore, taxpayers had to pay for nearly $190 billion in canceled loans that didn't really address the root cause of the problem. Today's delinquency rates would most likely be considerably higher if that money had not been squandered on this disastrous initiative.

This dishonesty is now having an economic impact. The credit ratings of millions of borrowers are starting to fall, and many are dealing with harsh collection procedures. The situation has caused a domino effect that could jeopardize financial stability and consumer confidence.

The Federal Reserve Bank of New York and Equifax have confirmed that millions of student loans were significantly past due during the final year of the Biden administration, despite President Trump's Department of Education truthfully disclosing the data. However, this information was deliberately concealed from voters and taxpayers.

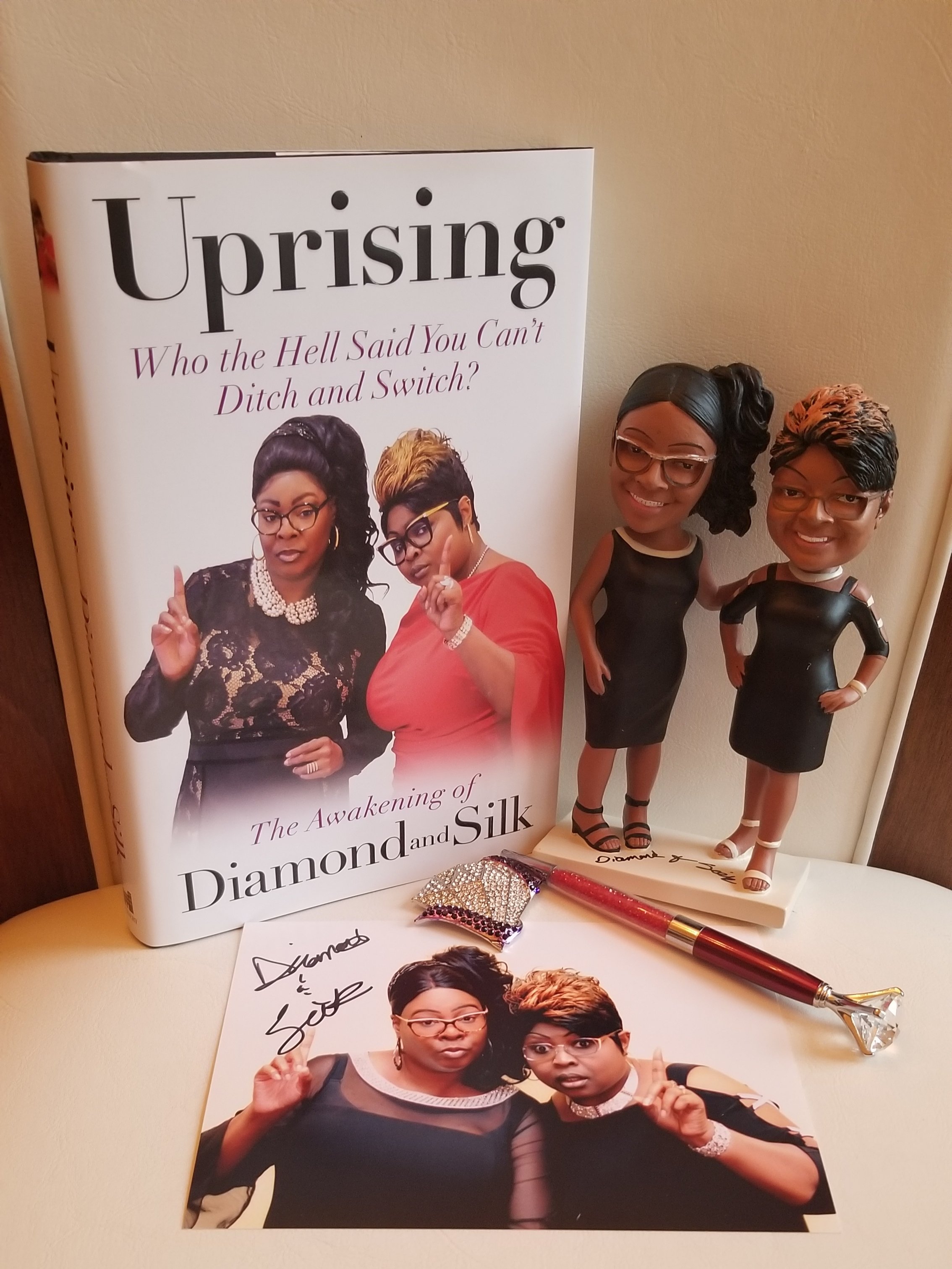

To join the Diamond and Silk Monthly Supporter Program, visit http://SupportDiamondandSilk.com.

Lindell TV, VOCL, ChatDit, Rumble, TruthSocial, and Diamond and Silk Media are all excellent ways to stay connected with Diamond and Silk.